Introduction

Hey there! Have you ever wondered about those insurance premiums and how they work? Well, you’re in the right place. Today, we’re diving into one particular type of premium – level premiums. But what exactly are they, and why should you care? Stick around because we’re about to unravel the mystery and show you why level premiums can be a game-changer in your insurance journey. Whether you’re new to this or just looking for some clarity, we’ve got you covered. So, let’s get started!

What are Level Premiums

Alright, let’s start with the basics. What exactly are these level premiums we keep talking about?

Think of level premiums as your financial anchor in the world of insurance. They’re a type of premium structure where the amount you pay for your insurance stays consistent over time. Yes, you heard that right – it doesn’t change as you get older.

Here’s how it works: when you first sign up for a policy with level premiums, your insurer calculates your premium based on various factors like your age, health, and the coverage you need. This initial premium is set and remains unchanged for the duration of your policy.

So, why is this a big deal? Well, imagine you start your insurance journey with a level premium. You’ll pay the same amount each month or year, making budgeting a breeze. No surprise hikes in your premium as you celebrate more birthdays – how awesome is that?

But it’s not just about predictability. Level premiums offer something invaluable – stability. Knowing that your premium won’t suddenly skyrocket means you can plan your finances with confidence. You won’t have to worry about stretching your budget to cover increasing insurance costs down the road.

Now, we get it – insurance lingo can be confusing, but stick with us. In the next sections, we’ll explore the benefits of level premiums, who should consider them, and how they stack up against other premium structures. So, keep reading to uncover why level premiums might be your ticket to a smoother, more predictable insurance journey.

The Benefits of Level Premiums

Alright, we’ve got the basics down – level premiums stay the same over time. But why should you care? Well, let’s dig into the juicy benefits of these steady-as-a-rock premiums.

- Predictability: Imagine you’re planning your monthly budget. With level premiums, you can confidently predict how much you’ll pay for insurance each month or year. No surprises, no budgeting acrobatics – just consistency.

- Long-term Stability: Level premiums are like that reliable friend who’s always there when you need them. They stay constant over the life of your policy, whether it’s 10, 20, or even 30 years. That means you won’t face sudden spikes in your premiums just because you’ve aged another year.

- Cost-effectiveness: Here’s the secret sauce – while level premiums might seem a tad higher in your younger years compared to other premium types, they often become more cost-effective as you go along. Why? Because as you age, other premium structures, like stepped premiums, tend to shoot up, while your level premiums remain as steady as ever. In the long run, you could end up saving a bundle.

- Financial Peace of Mind: Life throws curveballs, but your insurance premiums don’t have to be one of them. Level premiums provide a sense of financial peace of mind. You know exactly what you’re paying for, and that knowledge lets you focus on what really matters – your loved ones and your future.

So, there you have it – the fantastic benefits of level premiums. But here’s the thing, level premiums aren’t for everyone. In the next section, we’ll dive into who should consider this premium type. Stay with us to find out if level premiums are your insurance soulmate.

Who Should Consider Level Premiums?

Now that we’ve covered why level premiums are pretty darn amazing, you might be wondering, “Are they right for me?” The answer depends on your life stage and financial goals. Let’s break it down.

- Young Professionals: If you’re just starting your career, level premiums can be a smart choice. They might seem a tad higher than other premium types initially, but remember, they stay consistent over time. Plus, you’ll lock in a lower rate while you’re still young and healthy.

- Young Families: Building a family is exciting, but it comes with added responsibilities. Level premiums offer financial predictability, making them a great fit for young parents. You can ensure your loved ones are protected without worrying about premium hikes.

- Long-Term Planners: Are you the type who thinks ahead? If your financial planning spans decades, level premiums could be your best friend. They remain unchanged as you age, so you’ll avoid the rising costs associated with other premium structures.

- Budget-Conscious Individuals: Consistency is key for many budget-conscious individuals. Level premiums provide just that – a steady, unchanging premium that makes budgeting a breeze.

- Anyone Seeking Peace of Mind: Life is full of surprises, and insurance is your safety net. If you value the peace of mind that comes with knowing your premiums won’t spike unexpectedly, level premiums are a solid choice.

While level premiums offer fantastic benefits, they may not be the ideal choice for everyone. In the next section, we’ll compare level premiums with other premium structures to help you make an informed decision. So, stay tuned to find out which premium type aligns best with your insurance goals.

Level Premiums vs. Other Premium Structures

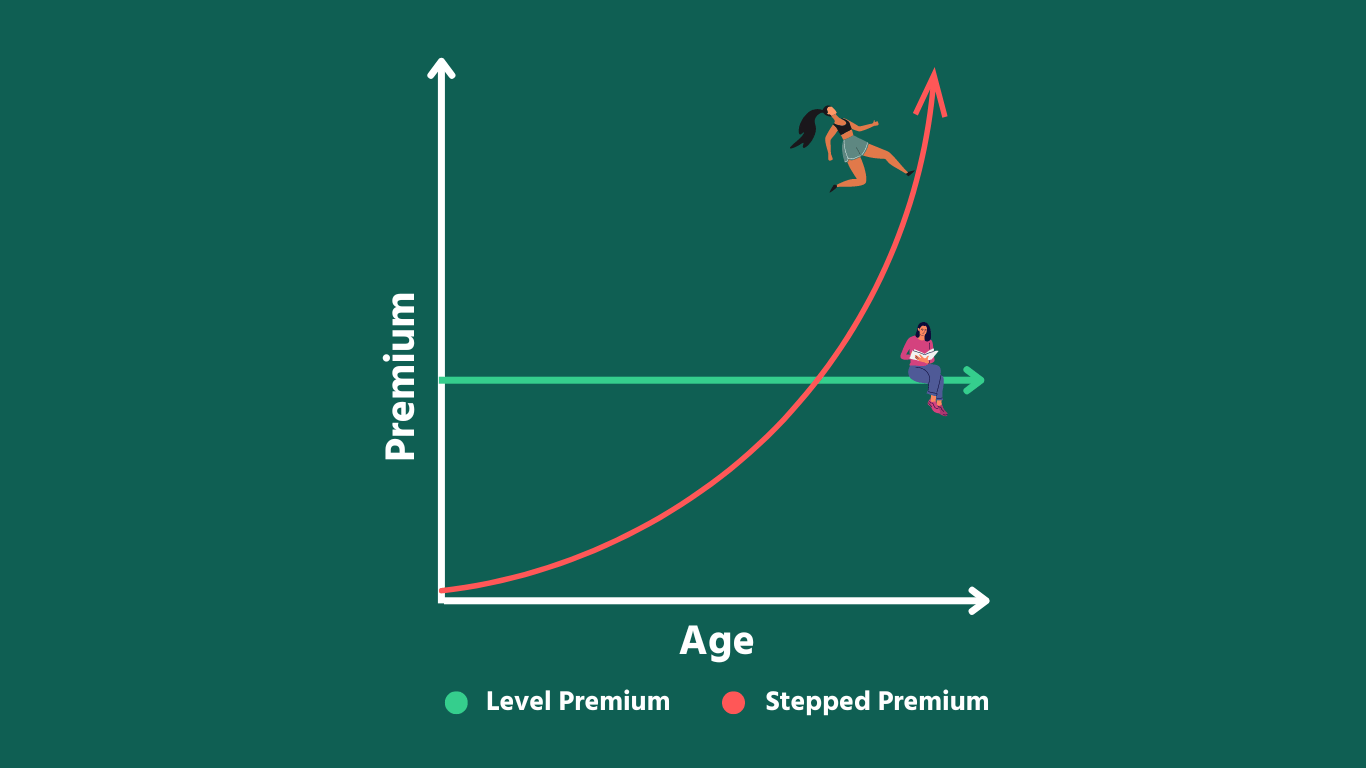

So, you’re sold on the idea of level premiums, but before you commit, let’s do a little comparison shopping. How do level premiums stack up against other premium structures like stepped premiums?

Level Premiums:

Stability: Your premiums remain constant throughout the life of your policy.

Predictability: Budgeting is a breeze with fixed premiums.

Long-term Savings: While they might seem slightly higher at the start, they can often save you money over time as other premium types increase with age.

Stepped Premiums:

Initial Affordability: Stepped premiums start lower, making them attractive for young policyholders.

Increasing Costs: Your premiums increase as you age, reflecting the higher risk of insuring an older individual.

Budget Challenges: While they may be more affordable initially, stepped premiums can become significantly more expensive in the long run.

Hybrid Premiums:

Flexibility: Hybrid premiums combine elements of both level and stepped premiums, offering some stability while accommodating changing needs.

Customisation: They allow you to tailor your premium structure to your specific requirements.

Cost Considerations: Hybrid premiums often strike a balance between initial affordability and long-term predictability.

The choice between level, stepped, or hybrid premiums depends on your unique circumstances and financial goals. If you value consistent, predictable premiums and long-term stability, level premiums might be your top pick. But remember, insurance is never one-size-fits-all.

In the next section, we’ll guide you on how to make the right choice when it comes to premium structures. So, keep reading to uncover the secrets of choosing the perfect premium type for your needs.

How to Choose the Right Premium Structure

Alright, so you’re at the crossroads of choosing the perfect premium structure for your insurance needs. Here’s a roadmap to help you make the right call.

- Assess Your Life Stage: Consider where you are in life. Are you just starting your career, planning a family, or nearing retirement? Your life stage plays a crucial role in determining the right premium structure. Level premiums, as we’ve discussed, are great for long-term planning.

- Evaluate Your Budget: Take a close look at your budget and financial goals. If you value consistency and predictability, level premiums are a solid choice. Stepped premiums may seem more affordable initially, but they can become pricier down the road.

- Consult with an Advisor: Don’t navigate the premium jungle alone. Reach out to a trusted insurance advisor, like the experts at Newma, to get personalized guidance. They can help you weigh the pros and cons, taking your unique circumstances into account.

- Consider Future Needs: Think about the long game. What are your future financial goals? Level premiums can offer long-term savings and financial stability, making them ideal if you’re planning for the years ahead.

- Review Policy Options: Check if the insurance policies you’re interested in offer level premiums as an option. Some policies may only have stepped premiums. It’s essential to ensure your chosen premium structure aligns with your goals.

- Stay Informed: Lastly, stay informed about any changes in your insurance policy. Review your coverage regularly to ensure it still meets your needs. Your financial situation and goals may evolve over time, and your insurance should adapt accordingly.

Remember, the right premium structure depends on your individual circumstances and objectives. There’s no one-size-fits-all answer. By following these steps and seeking expert advice, you can make an informed decision that sets you on the path to financial security.

In the next section, we’ll tackle some common questions about level premiums. So, keep reading to get all the answers you need.

Common Questions About Level Premiums

Before we wrap up, let’s address some common questions about level premiums:

Q1: Are level premiums more expensive than other types?

A1: Initially, level premiums might seem slightly higher than stepped premiums. However, they often become more cost-effective over time, especially as other premium structures increase with age.

Q2: Can I switch from another premium type to level premiums?

A2: In many cases, yes, you can switch to level premiums if your policy allows it. However, it’s essential to consult with your insurance provider or advisor to understand the specific terms and conditions.

Q3: Do level premiums guarantee lower costs in the long run?

A3: While level premiums typically remain stable over time, they may not always be the cheapest option initially. However, they can lead to long-term savings as you age.

Conclusion

In the world of insurance, where uncertainties lurk around every corner, level premiums stand as a beacon of stability and predictability. They offer a clear path to financial security, ensuring that your loved ones are protected without breaking the bank.

Choosing the right premium structure is a significant decision, and it’s essential to align it with your unique circumstances and financial goals. Whether you’re just starting your journey or planning for retirement, level premiums can provide the peace of mind you deserve.

At Newma, we’re here to guide you every step of the way. Our team of experienced advisors is dedicated to helping you make the best choices for your insurance needs. If you’re ready to explore the world of level premiums or have more questions, don’t hesitate to reach out. Your financial future deserves the best protection, and we’re here to make it happen.

So, why wait? Start your journey towards financial stability today with level premiums – your ticket to a smoother, more predictable insurance experience.