Mortgage protection insurance is an essential safeguard for homeowners, ensuring your mortgage is covered if unforeseen events impact your ability to make payments. This guide explores the nuances of mortgage protection insurance, its importance, and how it can provide financial security in uncertain times.

What is Mortgage Protection Insurance?

Mortgage protection insurance is designed to cover your mortgage payments if you are unable to work due to death, disability, or critical illness. Its key components include:

- Total & Permanent Disablement (TPD) Benefits: Covers your mortgage if you become totally and permanently disabled.

- Trauma Benefits: Provides coverage if you suffer from specified critical illnesses.

- Monthly Mortgage Repayment Benefits: Assists with monthly mortgage payments if you’re unable to work due to illness or injury.

A unique feature of mortgage protection insurance is that it does not offset the insured mortgage repayment amount based on your income, providing full coverage for your mortgage.

Key Components of Mortgage Protection Insurance

Life Insurance

- Function and Purpose: Pays off the outstanding mortgage balance upon the insured’s death.

- Coverage Details and Exclusions: Typically covers the full loan amount but may exclude death due to pre-existing conditions.

Monthly Mortgage Repayment Benefits

- Function and Purpose: Provides monthly payments towards your mortgage if you are temporarily unable to work.

- Customisation Options: Policies can be tailored with varying waiting periods (time before benefits begin) and payment periods (duration of benefit payments).

- Differences from Regular Income Protection: Unlike income protection, these benefits are specifically for mortgage payments and are not reduced by other income sources.

How Much Mortgage Protection Insurance Do I Need?

Determining the right amount of coverage depends on your income and financial situation:

- Assessing Needs Based on Income Dynamics:

- Sole Income Earner: Higher coverage to ensure full mortgage payment.

- Major Income Earner: Consider coverage that reflects your contribution to household income.

- Joint Equal Income Earners: Balanced coverage to share the mortgage payment burden.

- Cost-Effective Approaches to Coverage: Evaluate your mortgage balance, existing savings, and other insurance policies.

- Tips for Determining the Right Amount of Coverage: Use mortgage calculators and seek professional advice to tailor your policy.

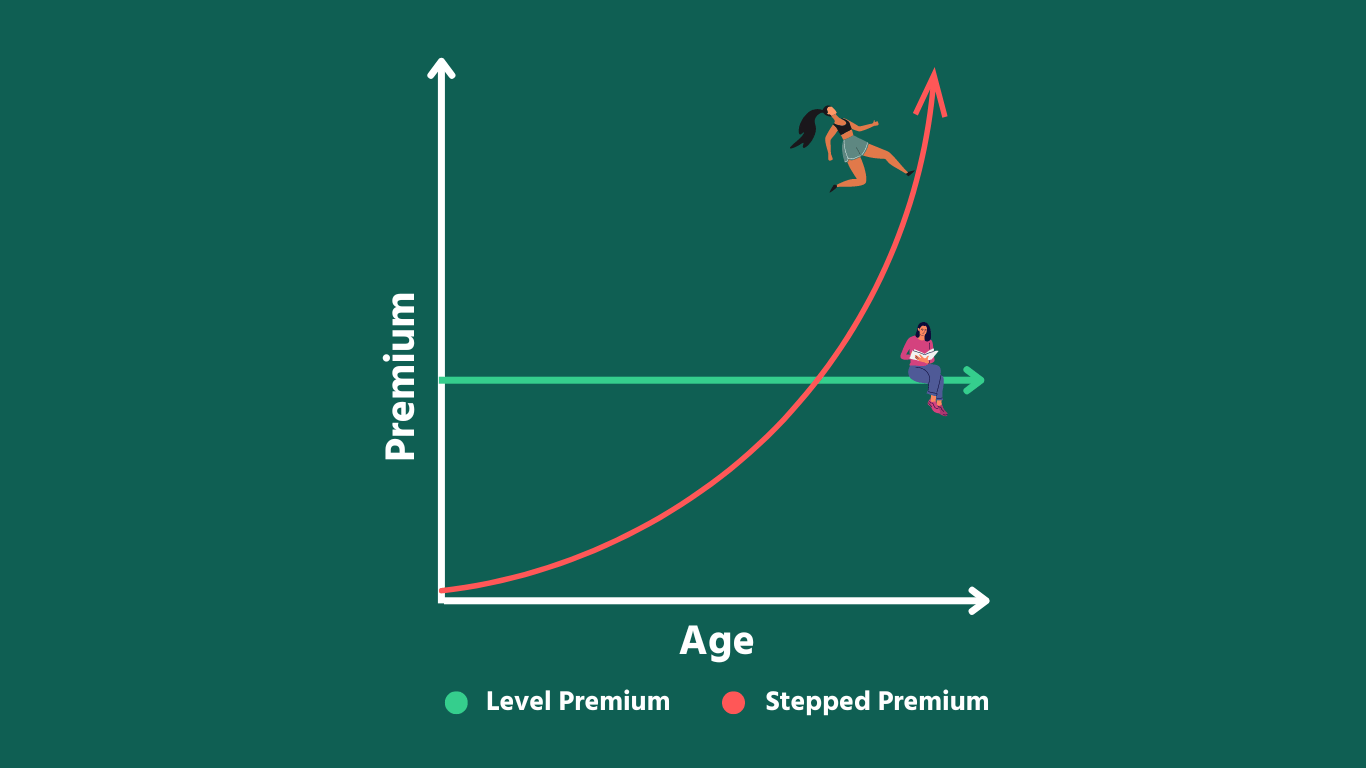

How Much Does Mortgage Protection Insurance Cost?

Costs vary based on several factors:

- Age, Gender, Occupation, and Health Status: Younger, healthier individuals typically pay lower premiums.

- Indicative Prices for Different Profiles: Premiums can range significantly; comparing quotes is essential.

- Importance of Comparing Quotes from Different Insurers: Using tools like LifeDirect ensures you find the best price and coverage.

Advantages of Having Mortgage Protection Insurance:

- Financial Security: Ensures your family can remain in your home.

- Flexibility and Peace of Mind: Customizable policies to fit your specific needs.

Conclusion

Mortgage protection insurance is a crucial tool for securing your home against life’s uncertainties. Assess your individual needs, obtain suitable coverage, and ensure your financial security. For personalised advice, get a quote online or contact a professional. Use comparison tools and consult with insurance advisors to secure the best deal.

Ready to secure your mortgage? Get a quote online today or contact one of our professional advisors for personalised advice. Ensure your financial security and peace of mind by exploring your options and choosing the right mortgage protection insurance for you.