When it comes to protecting what matters most, the choices we make can be surprising. According to recent findings from the Consumer Confidence Survey 2024, more than twice as many New Zealanders insure their cars than their health. This startling statistic begs the question: are we prioritising our immediate assets over our long-term well-being?

The Car vs Health Dilemma

Car insurance dominates as the most commonly owned insurance product in New Zealand, reflecting our high level of car ownership. On the surface, this makes sense—cars are valuable, essential for many households, and often required for commuting. But what about our health, which underpins our ability to work, earn, and live well?

Health insurance ownership remains significantly lower, even though medical expenses can quickly surpass the value of a car in a serious situation. Younger New Zealanders (18–34) are slightly more likely to invest in health insurance than older generations, but the gap remains concerning across all age groups.

Why This Gap Exists

The survey highlights several factors that may contribute to this disparity:

- Affordability Concerns: Many households, particularly those with lower incomes, find insurance premiums a stretch for their budgets. While car insurance is often seen as essential (and legally required for some), health insurance may feel like a luxury.

- Perceived Immediate Need: Car accidents are frequent, making car insurance benefits more tangible. In contrast, health insurance may seem less urgent unless someone has experienced significant medical issues.

- Confidence and Understanding: The survey also reveals gaps in financial literacy and confidence, especially among women, Māori, Pacific Peoples, and low-income households. Without clear guidance, many may overlook health insurance as an option or fail to understand its long-term value.

Why Health Insurance Matters

While car insurance protects a tangible asset, health insurance safeguards something far more critical, your ability to live a healthy and financially secure life. Here’s why it deserves more attention:

- Financial Protection: Unexpected medical costs, from hospital stays to specialist care, can derail even the best financial plans.

- Quicker Access to Care: Health insurance can reduce waiting times for non-urgent treatments, ensuring you get the care you need when you need it.

- Peace of Mind: Knowing you’re covered allows you to focus on recovery rather than costs in times of illness or injury.

How to Rethink Your Priorities

If health insurance has taken a back seat in your financial planning, now is the time to reconsider. Start by:

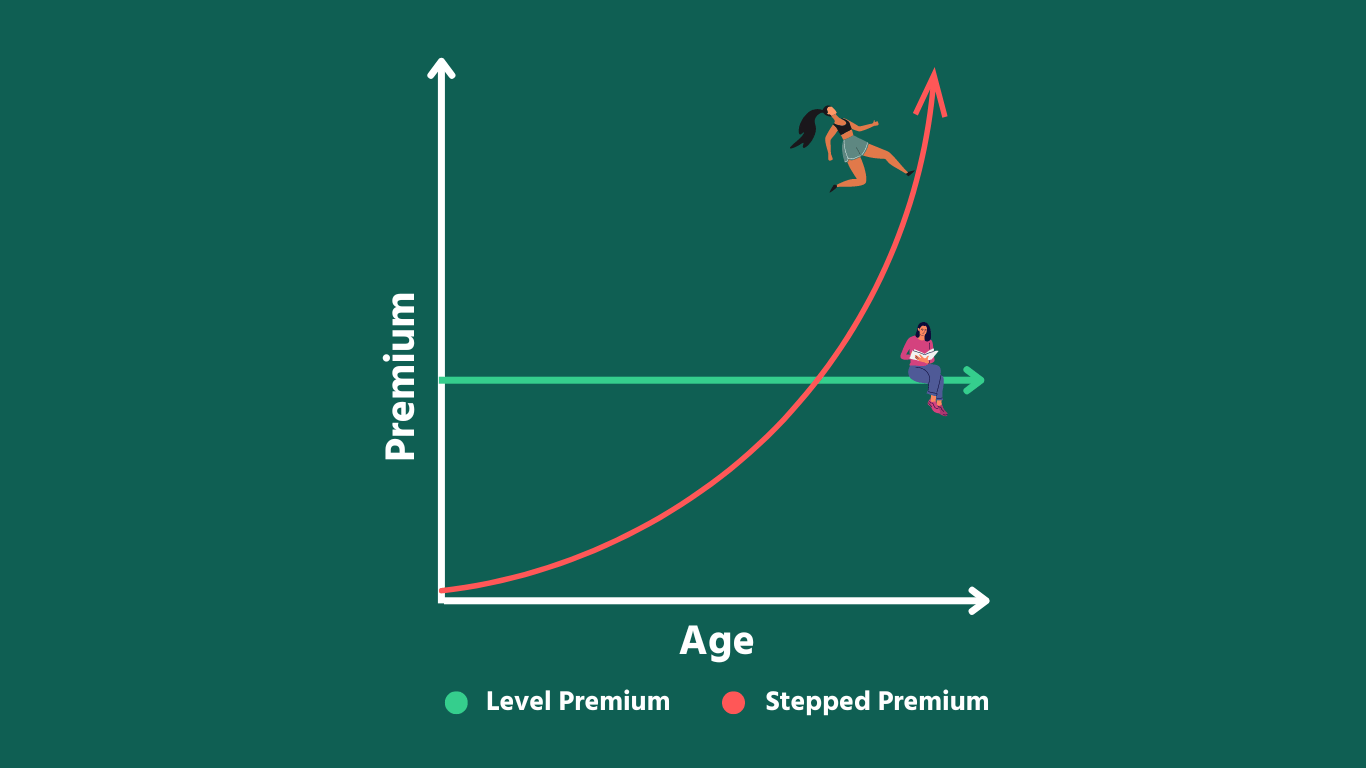

- Assessing Your Needs: Consider your age, family situation, and current health status. Younger individuals may benefit from starting a policy early to lock in lower premiums and having less exclusions.

- Budgeting for Coverage: Review your expenses to see where adjustments can be made to include health insurance. Even basic coverage can make a difference.

- Seeking Expert Advice: Unsure where to start? Talking to a financial adviser can help you navigate your options and find a policy that fits your needs and budget.

Conclusion

The Consumer Confidence Survey serves as a wake-up call for many of us to rethink our priorities. While insuring your car is important, ensuring your health is vital. After all, your health is the engine that drives everything else in your life, from your ability to work and earn to enjoying quality time with loved ones.

Let’s start the conversation about making health insurance an essential part of financial confidence. Protect yourself, protect your future.