Understanding what goes into your insurance premium can often feel like unraveling a mystery. While it might seem like a simple monthly payment, numerous factors influence how much you pay for your life, health, or income protection insurance. Let’s delve into the key elements that shape your insurance costs and help you make informed decisions about your coverage.

1. Type of Insurance

The kind of insurance you choose significantly impacts your premium. Life insurance, health insurance, and income protection insurance each have different risk factors and coverage benefits. For instance, life insurance premiums are primarily based on age and health, whereas health insurance costs can vary based on the level of cover and additional benefits like dental or optical.

2. Your Age

Age is a major factor in determining insurance premiums. Generally, younger individuals pay lower premiums because they are considered less risky to insure. As you age, the likelihood of health issues increases, which can lead to higher premiums.

3. Health and Lifestyle Factors

Your current health and medical history, along with your lifestyle choices, play a crucial role in shaping your insurance costs. Insurers typically require a health assessment or a detailed medical history to evaluate your risk level. Here are some specific aspects they consider:

- Pre-existing Conditions: Chronic illnesses or past health issues can raise your premiums.

- Smoking Habits: Smokers usually pay more due to the associated health risks.

- Body Mass Index (BMI): A higher BMI can indicate potential health problems, affecting premiums.

- Alcohol Consumption: Excessive drinking may lead to higher premiums.

- Exercise and Diet: A healthy lifestyle can positively impact your premium costs.

- Risky Activities: Participation in extreme sports or dangerous hobbies can increase your premium.

4. Occupation

Your job can also influence your insurance premiums. Occupations deemed high-risk, such as construction or mining, often come with higher premiums compared to office-based jobs. This is due to the increased likelihood of injury or illness associated with high-risk professions.

5. Coverage Amount and Term

The amount of coverage you choose and the length of the term also affect your premium. Higher coverage amounts mean higher premiums, as the insurer’s potential payout increases. Similarly, longer-term policies can cost more because the insurer covers you for an extended period.

6. Policy Type and Features

Different policy types and features can impact your premium. For instance, a policy with added benefits like critical illness cover, waiver of premium, or indexation (which keeps your cover in line with inflation) will generally cost more. Tailoring your policy to include only the necessary features can help manage costs.

7. Stepped vs Level Premiums

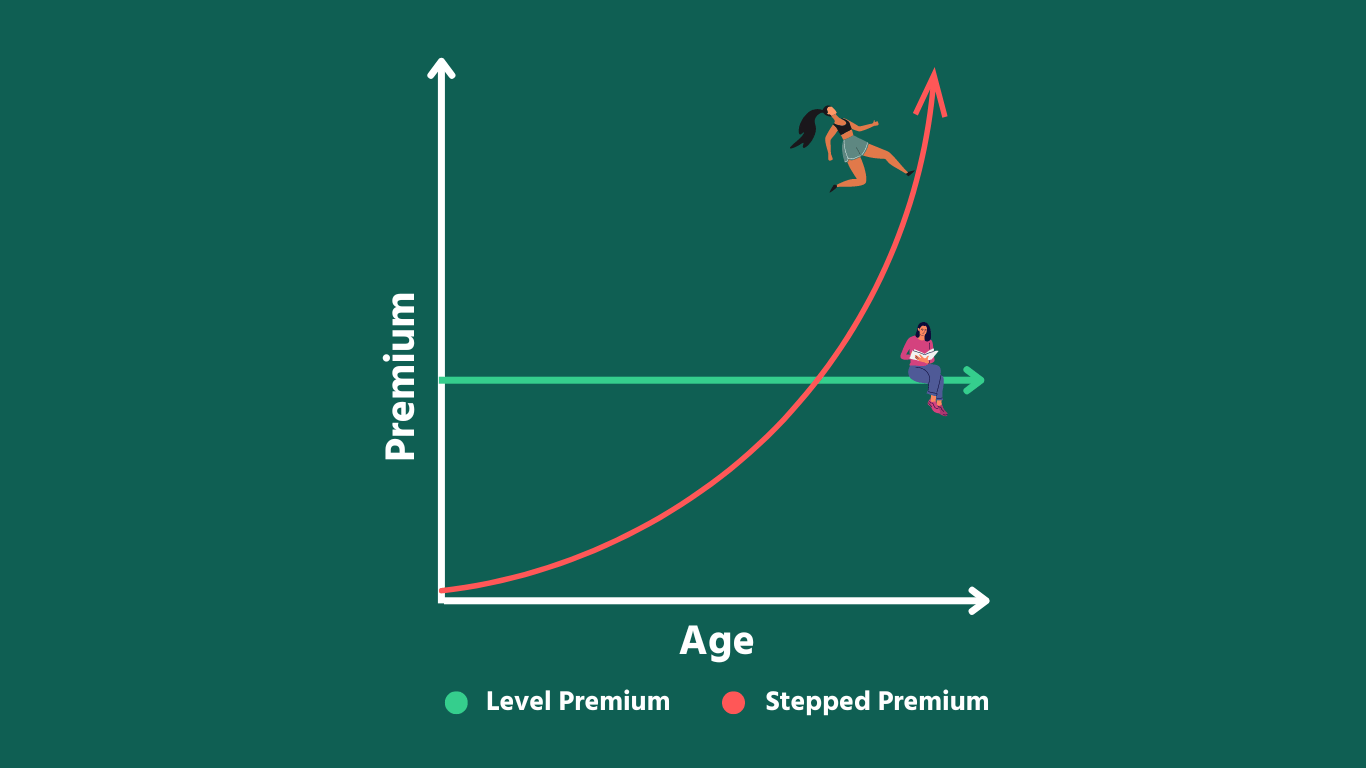

When choosing a policy, you often have the option between stepped and level premiums:

- Stepped Premiums: These premiums start lower but increase each year as you age. They may be more affordable initially but can become costly over time.

- Level Premiums: These premiums remain constant throughout the policy term, starting higher but potentially saving you money in the long run as they do not increase with age.

8. Family Medical History

Your family’s medical history can provide insight into potential hereditary conditions that might affect your health in the future. Insurers may consider this information when calculating your premium, particularly if there is a history of serious illnesses.